The Pradhan Mantri Jan Dhan Yojana (PMJDY) – the National Mission for Financial Inclusion – completes nine years of successful implementation today.

The PMJDY was announced by Prime Minister Shri Narendra Modi in his Independence Day address on 15th August 2014. While launching the programme on 28th August 2014, the Prime Minister had described the occasion as a festival to celebrate the liberation of the poor from a vicious cycle.

a

a

Being one of the biggest financial inclusion initiatives in the world, the Ministry of Finance continuously endeavours to provide financial inclusiveness and support to the marginalised and economically backward sections through its financial inclusion led interventions. Financial Inclusion (FI) promotes equitable and inclusive growth as well as delivery of financial services at an affordable cost to vulnerable groups such as low-income groups and weaker sections that lack access to basic banking services.

Financial Inclusion also brings savings of the poor into the formal financial system and provides an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

On the 9th anniversary of PMJDY, Union Finance Minister Smt. Nirmala Sitharaman, in her message said, “The 9 years of PMJDY-led interventions and digital transformation have revolutionised financial inclusion in India. It is heartening to note that more than 50 crore people have been brought into the formal banking system through the opening of Jan Dhan Accounts. Among these accounts, approximately 55.5% belong to women, and 67% have been opened in Rural / Semi-Urban areas. The cumulative deposits in these accounts surpass ₹2 lakh crore. Furthermore, about 34 crore RuPay cards have been issued to these accounts without charge, which also provides for a ₹2 lakh accident insurance cover.”

“With the collaborative efforts of stakeholders, banks, insurance companies, and government officials, the PMJDY stands out as a pivotal initiative, changing the landscape of financial inclusion in the country as envisioned by Hon’ble Prime Minister Shri Narendra Modi,” Smt. Sitharaman said.

Union Minister of State for Finance Dr. Bhagwat Kisanrao Karad also expressed his thoughts for PMJDY on this occasion. He said, “PMJDY scheme has reduced financial untouchability by bringing the marginalised sections of the society into the ambit of formal banking. By providing access to banking facilities to vulnerable sections of the society, facilitating access to availability of credit, providing insurance and pension coverage and creating financial awareness, the outcomes of the scheme are far reaching and have a multiplier effect on the economy. Further, Jan Dhan–Aadhaar–Mobile (JAM) architecture has enabled successful transfer of Government benefits in the accounts of common man seamlessly. PMJDY accounts have become fulcrum of people-centric initiatives like DBT and has contributed towards inclusive growth of all sections of the society, especially the underprivileged.”

As we complete 9 years of successful implementation of this Scheme, we take a look at the major aspects and achievements of this Scheme so far.

Background

Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

- Objectives:

- Ensure access of financial products & services at an affordable cost

- Use of technology to lower cost & widen reach

- Basic tenets of the scheme

- Banking the unbanked – Opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance & zero charges

- Securing the unsecured – Issuance of Indigenous Debit cards for cash withdrawals & payments at merchant locations, with free accident insurance coverage of Rs. 2 lakhs

- Funding the unfunded – Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit

- Initial Features of PMJDY

The scheme was launched based upon the following 6 pillars:

Universal access to banking services – Branch and BC

- Basic savings bank accounts with overdraft facility of Rs. 10,000/- to every eligible adult

- Financial Literacy Programme– Promoting savings, use of ATMs, getting ready for credit, availing insurance and pensions, using basic mobile phones for banking

- Creation of Credit Guarantee Fund – To provide banks some guarantee against defaults

- Insurance – Accident cover up to Rs. 1,00,000 and life cover of Rs. 30,000 on account opened between 15 Aug 2014 to 31 January 2015

- Pension scheme for Unorganised sector

- Important approach adopted in PMJDY based on experience:

Accounts opened are online accounts in core banking system of banks, in place of earlier method of offline accounts opening with technology lock-in with the vendor

-

- Inter-operability through RuPay debit card or Aadhaar enabled Payment System (AePS)

- Fixed-point Business Correspondents

- Simplified KYC / e-KYC in place of cumbersome KYC formalities

- Extension of PMJDY with New features – The Government decided to extend the comprehensive PMJDY programme beyond 28.8.2018 with some modifications

- Focus shifted from ‘Every Household’ to Every Unbanked Adult’

- RuPay Card Insurance – Free accidental insurance cover on RuPay cards increased from Rs. 1 lakh to Rs. 2 lakhs for PMJDY accounts opened after 28.8.2018.

- Enhancement in overdraft facilities: OD limit doubled from Rs 5,000/- to Rs 10,000/-; OD upto Rs 2,000/- (without conditions) with Increase in upper age limit for OD from 60 to 65 years

- Impact of PMJDY

PMJDY has been the foundation stone for people-centric economic initiatives. Whether it is direct benefit transfers, COVID-19 financial assistance, PM-KISAN, increased wages under MGNREGA, life and health insurance cover, the first step of all these initiatives is to provide every adult with a bank account, which PMJDY has nearly completed.

One in 2 accounts opened between March 2014 to March 2020 was a PMJDY account. Within 10 days of nationwide lockdown more than about 20 crore women PMJDY accounts were credited with financial assistance of Rs 500 per month for three months through DBT in each women PMJDY account.

During COVID-19 pandemic, we have witnessed the remarkable swiftness and seamlessness with which Direct Benefit Transfer (DBTs) have empowered and provided financial security to the vulnerable sections of society. An important aspect is that DBTs via PMJDY accounts have ensured every rupee reaches its intended beneficiary and preventing systemic leakage.

PMJDY has brought the unbanked into the banking system, expanded the financial architecture of India and brought financial inclusion to almost every adult.

- Achievements under PMJDY- As on 16th August’23:

- PMJDY Accounts

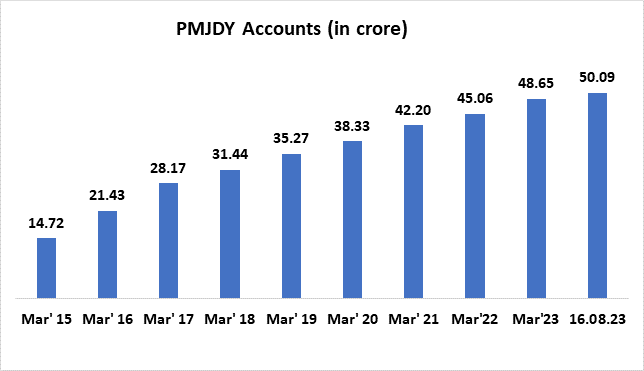

As on 9th August 23 number of total PMJDY Accounts: 50.09 crore; 55.6% (27.82 crore) Jan-Dhan account holders are women and 66.7% (33.45 crore) Jan Dhan accounts are in rural and semi-urban areas

- During first year of scheme 17.90 crore PMJDY accounts were opened

- Continuous increase in no of accounts under PMJDY

- PMJDY Accounts have grown three-fold (3.4) from 14.72 crore in March 15 to 50.09 crore as on 16-08-2023. Undoubtedly a remarkable journey for the Financial Inclusion Programme.

[Deposits under PMJDY accounts –

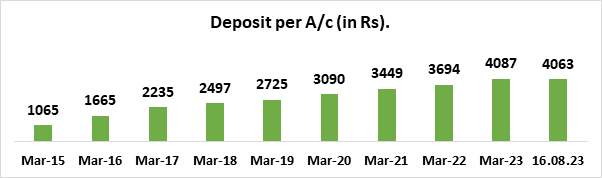

Total deposit balances under PMJDY Accounts stand at Rs. 2,03,505 crore

- Deposits have increased about 13 times with increase in accounts 3.34 times (Aug’23 / Aug’15)

Average Deposit per PMJDY account –

Average deposit per account is Rs. 4,063 as on 16.08.2023

- Avg. Deposit per account has increased over 3.8 times over August 15

- Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habit among account holders

- RuPay Card issued to PMJDY account holders

Total RuPay cards issued to PMJDY accountholders: 33.98 crore

- Number of RuPay cards & their usage has increased over time

- Jan Dhan Darshak App (JDD App)

JDD App is a mobile application which provides a citizen centric platform for locating banking touch points such as bank branches, ATMs, Banking Correspondents (BCs), Indian Post Payment Banks etc. in the country. Over 13 lakh banking touchpoints have been mapped on the JDD App. The facilities under Jan Dhan Darshak App could be availed as per the need and convenience of common people. The web version of this application could be accessed at the link http://findmybank.gov.in.

This app is also being used for identification of villages which are yet to covered by banking outlets within 5 km radius. These identified villages are allocated to various banks by concerned SLBCs for opening of banking outlets. The efforts have resulted in a significant decrease in number of uncovered villages.

A total of 6.01 lakh villages are mapped on the JDD app as of July 2023. Out of these, 5,99,468 (99.7%) of total mapped villages are covered with banking outlets (Bank branch, Banking corner or Indian Post Payment Banks (IPPB) within 5 km radius).

- Towards ensuring smooth DBT transactions

As informed by banks, about 6.26 crore PMJDY accountholders receive direct benefit transfer (DBT) from the Government under various schemes. To ensure that the eligible beneficiaries receive their DBT in time, the Department takes active role in identification of avoidable reasons for DBT failures in consultation with DBT Mission, NPCI, banks and various other Ministries.

- Digital transactions: With the issue of over 33.98 crore RuPay debit cards under PMJDY, installation of 79.61 lakh PoS/mPoS machines and the introduction of mobile based payment systems like UPI, the total number of digital transactions have gone up from 1,471 crore in FY 17-18 to 11,394 crore in FY 22-23. The total number of UPI financial transactions have increased from 92 crore in FY 2017-18 to 8,371 crore in FY 2022-23. Similarly, total number of RuPay card transactions at PoS & e-commerce have increased from 67 crore in FY 2017-18 to 126 crore in FY 2022-23.

The road ahead

- Endeavour to ensure coverage of PMJDY account holders under micro insurance schemes. Eligible PMJDY accountholders will be sought to be covered under PMJJBY and PMSBY. Banks have already been communicated about the same.

- Promotion of digital payments including RuPay debit card usage amongst PMJDY accountholders through creation of acceptance infrastructure across India

- Improving access of PMJDY account holders to Micro-credit and micro investment such as flexi-recurring deposit etc.

Comments are closed.