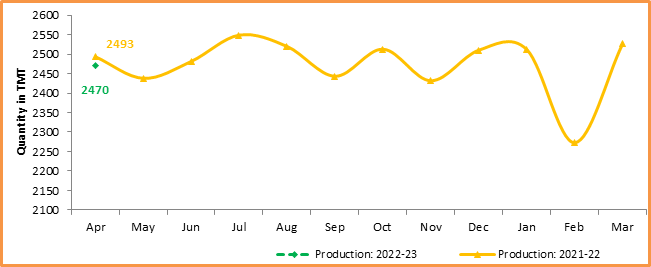

New Delhi : Crude oil production[1] during April, 2022 was 2469.67 TMT which is 3.47% higher than target but 0.95% lower than the production during April, 2021. Unit-wise and State-wise crude oil production is given at Annexure-I. Unit-wise crude oil production for the month of April, 2022 vis-à-vis same period of last year are shown in Table-1 and month-wise in Figure-1.

Table-1: Crude Oil Production (in TMT)

| Oil & Gas Company | Target | April (Month) | |||

| 2022-23 (Apr-Mar) | 2022-23 | 2021-22 | % over last year | ||

| Target | Prod.* | Prod. | |||

| ONGC (Nomination Block) | 19088.24 | 1573.05 | 1650.65 | 1636.57 | 100.86 |

| OIL (Nomination Block) | 3571.00 | 253.47 | 251.46 | 242.74 | 103.59 |

| Pvt/JVs (PSC/RSC Regime) | 7561.01 | 560.40 | 567.57 | 613.95 | 92.45 |

| Total | 30220.26 | 2386.92 | 2469.67 | 2493.26 | 99.05 |

Note: 1. Target for the year 2022-23 is provisional, subject to finalization. *: Provisional

- Totals may not tally due to rounding off.

Figure-1: Monthly Crude Oil Production

Unit-wise production details with reasons for shortfall are as under:

-

- Crude oil production by ONGC (Oil and Natural Gas Corporation) in nomination block during April, 2022 was 1650.65 TMT which is 4.93% higher than the target and 0.86% higher than the production during April, 2021.

-

- Crude oil production by OIL (Oil India Ltd) in the nomination block during April, 2022 was 251.46 TMT which is 0.79% lower than target but 3.59% higher than the production during April, 2020. Reasons for shortfall in production are as under:

- Less than planned contribution from workover wells, drilling wells and old wells.

- Bandhs /blockade by local people and associations etc. after the Baghjan Blowout, protests/agitation etc.

-

- Crude oil production by Pvt/JVs companies in the PSC/RSC (Production Sharing Contract) regime during April, 2022 was 567.57 TMT which is 1.28% higher than the target but 7.55% lower than the production during April, 2021. Reasons for shortfall in production are as under:

- AAP-ON-94/1 (HOEC): Production Shortfall due to Low consumer demand.

- AMGURI (OILMAX): Production Shortfall due to Low consumer demand.

- CB-ONN-2004/2 (ONGC): One development well in VD-3 discovery could not be drilled as planned.

- BAOLA (SUN): Production shortfall due to less than planned contribution from workover wells.

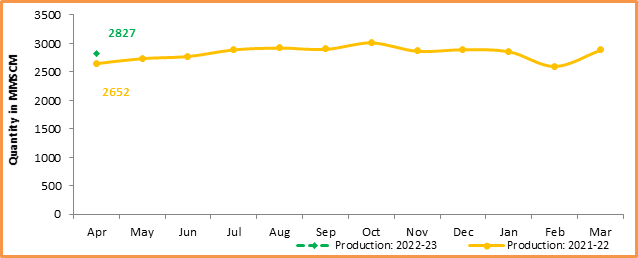

- Production of Natural Gas

Natural gas production during April,2022 was 2826.73 MMSCM which is 2.29% lower than the monthly target but 6.61% higher than the production during April, 2021. Unit-wise and state-wise natural gas production are given at Annexure-II. Unit-wise natural gas production for the month of April, 2022 and same period of last year are shown in Table-2 and month-wise in Figure-2.

Table-2: Natural Gas Production (in MMSCM)

| Oil Company | Target | April (Month) | |||

| 2022-23 (Apr-Mar) | 2022-23 | 2021-22 | % over last year | ||

| Target | Prod.* | Prod. | |||

| ONGC (Nomination Block) | 20798.12 | 1697.48 | 1707.99 | 1725.50 | 98.99 |

| OIL (Nomination Block) | 3717.84 | 303.51 | 244.92 | 215.13 | 113.85 |

| Pvt/JVs (PSC/RSC Regime) | 12049.45 | 891.87 | 873.82 | 710.90 | 122.92 |

| Total | 36565.41 | 2892.86 | 2826.73 | 2651.52 | 106.61 |

Note: 1. Target for the year 2022-23 is provisional, subject to finalization. *: Provisional

- Totals may not tally due to rounding off.

Figure-2: Monthly Natural Gas Production

-

- Natural gas production by ONGC in the nomination blocks during April, 2022 was 1707.99 MMSCM which is 0.62% higher than the target but 1.01% lower than the production during April, 2021. Reasons for shortfall in production are as under:

- Delay of HF in Mandapeta & Natural Decline in Pasarlapudi and CA-16 fields in Rajahmundry

- Decline in production from Gandhar, Jambusar and Dahej fields in Ankleshwar Asset.

-

- Natural gas production by OIL in the nomination block during April, 2022 was 244.92 MMSCM which is 19.30% lower than the monthly target but 13.85% higher than the production during April, 2021. Reasons for shortfall in production are as under:

- Low upliftment/demand of gas by the major customers.

- Less than planned contribution from workover wells, drilling wells and old wells.

-

- Natural gas production by Pvt/JVs companies in the PSC/RSC & CBM regime during April, 2022 was 873.82 MMSCM which is 2.02% lower than the target but 22.92% higher than the production during April, 2021.

- AAP-ON-94/1 (HOEC): Production Shortfall due to Low consumer demand.

- AMGURI (OILMAX): Production Shortfall due to Low consumer demand.

- RJ-ON/6 (FEL): Production shortfall due to compressor failures at Plant (Tripping issues).

- BAOLA (SUN): Production shortfall due to less than planned contribution from workover wells.

- KG-DWN-98/3 (RIL): Production shortfall due to closer of #AR1-Dev1 for build-up study from 16.04.2022 to 19.04.2022

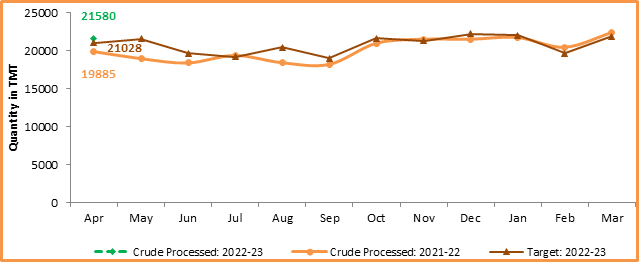

- Crude Oil Processed (Crude Throughput)

Crude Oil Processed during April, 2022 was 21579.61 TMT which is 2.62% higher than the target for the month and 8.52% higher vis-à-vis April, 2021. Capacity utilization during the April, 2022 was 104.51%. Refinery-wise details of the crude throughput and capacity utilization during the month of April, 2022 vis-à-vis April, 2021 are given at Annexure-III and Annexure-IV. Company-wise crude throughput for the month of April, 2022 vis-à-vis same period of last year are shown in Table-3 and month-wise in Figure-3.

Table 3: Crude Oil Processed (Crude Throughput) (in TMT)

| Oil Company | Target | April (Month) | |||

| 2022-23 (Apr-Mar) | 2022-23 | 2021-22 | % over last year | ||

| Target | Prod.* | Prod. | |||

| CPSE | 154983.78 | 13422.92 | 13728.86 | 12172.03 | 112.79 |

| IOCL | 69999.90 | 6085.05 | 6237.26 | 5980.31 | 104.30 |

| BPCL | 37000.00 | 3320.00 | 3300.36 | 3236.27 | 101.98 |

| HPCL | 18920.85 | 1525.90 | 1529.30 | 867.43 | 176.30 |

| CPCL | 10300.00 | 900.00 | 904.20 | 759.79 | 119.01 |

| NRL | 2800.00 | 236.62 | 270.72 | 221.22 | 122.38 |

| MRPL | 15900.00 | 1350.00 | 1480.97 | 1099.79 | 134.66 |

| ONGC | 63.04 | 5.36 | 6.05 | 7.23 | 83.70 |

| Pvt/JVs | 94637.83 | 7605.33 | 7850.75 | 7712.67 | 101.79 |

| HMEL | 11451.93 | 951.56 | 1039.86 | 1058.90 | 98.20 |

| RIL | 63021.49 | 5020.99 | 5150.91 | 5020.99 | 102.59 |

| NEL | 20164.41 | 1632.78 | 1659.98 | 1632.78 | 101.66587 |

| TOTAL | 249621.61 | 21028.25 | 21579.61 | 19884.70 | 108.52 |

Note: 1. Target for the year 2022-23 is provisional, subject to finalization. *: Provisional

2. Totals may not tally due to rounding off.

Figure 3: Crude Oil Processed (Crude Throughput)

3.1 CPSE Refineries’ crude oil processed during April, 2022 was 13728.86 TMT which is 2.28% higher than the target for the month and 12.79% higher than that of April, 2021. Reasons for shortfall in production are as under:

- IOCL-Panipat: Crude processed lower due to high TAN crude processing.

- HPCL-Mumbai: Crude processed lower due to shutdown of secondary processing unit.

3.2 Private and JVs Refineries’ crude oil processed during April, 2022 was 7850.75 TMT which is 3.23% higher than the target for the month and 1.79% higher than that of April, 2021.

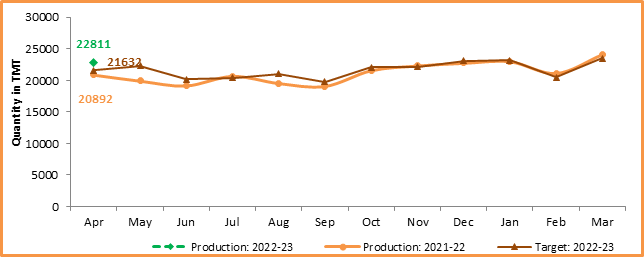

- Production of Petroleum Products

Production of Petroleum Products during April, 2022 was 22811.15 TMT which is 5.45% higher than the target for the month and 9.19% higher than the production during April, 2021. Refinery-wise production of petroleum products is given at Annexure-V. Company-wise production for the month of April, 2022 vis-à-vis April, 2021 are shown in Table-4 and month-wise in Figure-4.

Table 4: Production of Petroleum Products (TMT)

| Oil Company | Target | April (Month) | |||

| 2022-23

(Apr-Mar) |

2022-23 | 2021-22 | % over last year | ||

| Target | Prod.* | Prod. | |||

| CPSE | 144648.94 | 12545.20 | 12939.59 | 11566.88 | 111.87 |

| IOCL | 66322.30 | 5776.84 | 5919.84 | 5795.76 | 102.14 |

| BPCL | 34005.99 | 3056.00 | 3178.54 | 3125.04 | 101.71 |

| HPCL | 17495.57 | 1416.78 | 1471.63 | 807.56 | 182.23 |

| CPCL | 9614.24 | 839.94 | 775.34 | 611.19 | 126.86 |

| NRL | 2748.86 | 232.30 | 266.66 | 219.63 | 121.42 |

| MRPL | 14401.95 | 1218.24 | 1321.87 | 1000.96 | 132.06 |

| ONGC | 60.02 | 5.10 | 5.70 | 6.74 | 84.54 |

| Pvt/JVs | 111404.56 | 8820.05 | 9594.65 | 8958.81 | 107.10 |

| HMEL | 10528.86 | 894.97 | 990.40 | 1033.73 | 95.81 |

| RIL | 81492.18 | 6374.66 | 7048.66 | 6374.66 | 110.57 |

| NEL | 19383.52 | 1550.42 | 1555.59 | 1550.42 | 100.33 |

| Total Refinery | 256053.50 | 21365.24 | 22534.24 | 20525.69 | 109.79 |

| Fractionators | 3888.14 | 266.71 | 276.91 | 365.98 | 75.66 |

| TOTAL | 259941.64 | 21631.96 | 22811.15 | 20891.67 | 109.19 |

Note: 1. Target for the year 2022-23 is provisional, subject to finalization. *: Provisional

2. Totals may not tally due to rounding off.

Figure 4: Monthly Refinery Production of Petroleum Products:

-

- Production of petroleum Products by Oil’s Refineries during April, 2022 was 22534.24 TMT which is 5.47% higher than the target for the month and 9.79% higher than the production during April, 2021.

-

- Production of petroleum Products by Fractionators during April, 2022 was 276.91 TMT which is 3.82% higher than the target for the month but 24.34% higher than the production during April, 2021.

Comments are closed.