How well are the electricity distribution utilities or discoms as they are called by power sector stakeholders performing? The 12th Edition of Integrated Rating of Discoms, released today by the Union Minister for Power and New & Renewable Energy Shri R. K. Singh, provides a principled guide towards making such assessments and thus taking steps for further improvement.

Addressing the power sector stakeholders at the release event held at Shram Shakti Bhawan, New Delhi today, March 11, 2024, the Union Power and New & Renewable Energy Minister congratulated the DISCOMs for overall improvement in their performance for the year 2022-23 and spoke of the importance of ratings, noting that they are important for the public good. “The public need to know how the discoms are performing and what their efficiencies are. The ratings exercise is an important step towards transparency in governance. Besides this, the ratings also aim at encouraging discoms and energy departments which have low efficiencies to improve, as has happened in the past. The ratings are a mirror to the system. A number of utilities have improved their ratings.” While the number of DISCOMs in the A+ category have gone up from 12 in the 10th edition of Integrated Ratings to 14 in the 12th edition of Integrated Ratings, the number of discoms in the C category have come down from 32 in 10th Integrated Ratings to 17 in the 12th edition of Integrated Ratings.

The Minister observed that AT&C losses of discoms have come down and that they have been on a downward trajectory. “The billing efficiency has gone up and the collection efficiency was already high. Our motive behind implementing smart prepaid meters is to increase these efficiencies to 100%, which will also ensure that the AT&C losses of discoms come down to single-digit.”

The Minister said that some states which were not performing well have now started performing well. “However, one of the surprising things we have noticed is that some states which are regarded as developed or fast-developing have shown lower ratings for their discoms. This is critical. Unless and until our power sector is viable, we cannot grow, since then, we will not be able to buy power to distribute to our people, which would in turn result in loadshedding and deindustrialization.”

The Power Minister noted that one of the reasons for increase in power prices is that many discoms have not tied up resources for long-term power supply, making them dependent on short-term power purchases which is naturally higher than long-term prices. “This is one thing we are persuading the discoms, to enter into long-term PPAs for at least 85% of their electricity requirement. We have laid down Resource Adequacy Rules which stipulate that discoms have to tie up power to meet the needs of the areas they serve. We have also laid down rules which specify penalties for gratuitous loadshedding. We have also laid down consumer grievance redressal forums.”

The Power Minister informed that the power demand has been growing up at 9% in past 2-3 years and will continue to keep growing and that we are meeting that demand. “The power sector overall has become much more viable and has started attracting investment in all segments of the sector. Outstanding dues of state gencos have come down and dues of other gencos are fully paid. We will work out ways and means of ensuring that dues of state gencos too get paid on time. Share prices of all companies of public and private sectors in the power sector have gone up by 2-3 times and net value has gone up by 4-5 times. Power sector is the sector to invest in, since we have made the system viable.”

14 out of 52 distribution companies receive A+ rating; utilities of Gujarat, Haryana, Karnataka, Madhya Pradesh and Andhra Pradesh in A+ / A category

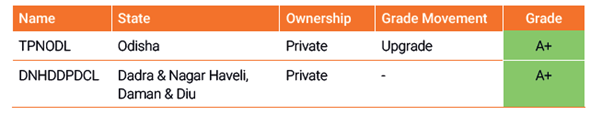

The 12th edition, which rates the performance of 53 electricity distribution utilities for the year 2022-23, gives 12 utilities the highest ranking of A+. In addition, two private utilities, TPNODL (Odisha) and DNHDDPDCL (Dadar, Nagar & Haveli, Daman & Diu) too have received A+ rating; however, they have not been included in the main ranking list since they have not completed three full years of operations.

The top five positions go to Adani Electricity Mumbai Ltd. (AEML) of Maharashtra at first position, Torrent Power Surat of Gujarat at second position, Torrent Power Ahmedabad of Gujarat at third position, followed by Gujarat’s state power utilities Dakshin Gujarat Vij Company Limited (DGVCL) and Uttar Gujarat Vij Company Limited (UGVCL) at fourth and fifth positions respectively. Among the 42 state power utilities which have been rated, 9 utilities belonging to Gujarat, Haryana, Karnataka, Madhya Pradesh and Andhra Pradesh have earned a rating of either A+ or A. All 11 private discoms have received a performance rating of either A+, A, B or B-.

The full list of ratings is as given below.

Integrated Ratings of State and Private Electricity Distribution Utilities

DISCOMs getting A+ Rating but not included in the list as they have not completed three full years of operations.

In all, out of the 55 utilities which have been rated, 14 have received a performance rating of A+, 4 have received A, 7 have received B, 13 have received B-, 11 have received C and 6 have received the rating of C-. No utility has received the lowest rating of D.

Thrissur Corporation Electricity Department (TCED) emerges as top-performing state power department

The 12th edition has also given integrated performance ratings to the power departments of 11 states and union territories. Among these, Thrissur Corporation Electricity Department (TCED) of Kerala has emerged on top, with a rating of A, followed by power departments of New Delhi Municipal Council at 2nd, Puducherry at 3rd, Goa at 4th and Nagaland at 5th positions, all with a rating of B.

In all, among the 11 power departments which figure in the performance ratings, no power department has received either the highest rating of A+ or the lowest rating of D.

Highlights of the 12th Edition of the Integrated Rating of Discoms

Some of the key findings of the 12th Edition of the Integrated Rating of Discoms are as given below.

- AT&C losses improved to 15.4% in FY23, Billing Efficiency improved to 87.0% and Collection Efficiency remained high at 97.3%.

- Late Payment Surcharge Rules drove reduction in payables to generation and transmission companies. Days Payable reduced to 126 days and Days Receivable also reduced to 119 days.

- State governments disbursed 108% of amounts booked for tariff subsidy during FY23. Further, a few states supported financial losses of discoms through subsidy grants, totaling to Rs. 44,000 crores during the year.

- Average power purchase cost increased by 71 paise/kWh during FY23, driven by 8% growth in power demand, more expensive coal imports and higher exchange prices especially during summers

- ACS-ARR gap, the cash-adjusted gap per unit energy, increased to 55 paise/kWh in FY23 due to purchase cost not being passed on fully to consumers.

Rating Framework and Scoring Methodology

How are the ratings done? The rating framework and scoring methodology for both state and private utilities and power departments of states and union territories are based broadly on financial sustainability, performance excellence and external environment, each of which is in turn assessed based on more specific parameters. In addition, specific disincentives too are provided, the presence of which adversely impact the ratings. The framework and scoring methodology can be found here.

Background

Since the year 2012, the Integrated Rating exercise is being carried out on an annual basis as per the methodology approved by the Ministry of Power, with the aim of evaluating performance of power distribution utilities. With the current report, the Ministry is publishing the results and insights from the 12th edition, conducted with the Power Finance Corporation as the nodal agency.

The framework adopted for the rating exercise has evolved over the years to reflect the changes in the power sector as well as the national priorities. The rating framework underwent a significant overhaul during the 10th Integrated Rating Exercise, with a focus on capturing the true financial picture (financial metrics on cash basis instead of accrual basis), vital role of external environment (state government and state regulator), and conformity to best sectoral practices (captured as negative scoring of Specific Disincentive metrics).

The 12th Integrated Rating continues the same rating framework used the year before – with the objective of capturing the performance changes based on the same methodology. The framework consists of 15 base rating metrics and nine disincentives, which together provide a score out of 100, to holistically capture a discom’s performance. Based on the integrated rating score and overriding conditions, each discom is assigned a specific grade (A+, A, B, B-, C, C- or D).

Comments are closed.