Introduction

Ministry of Statistics and Programme Implementation (MoSPI) has released the results of Annual Survey of Industries (ASI) for the reference periods April 2022 to March 2023 (i.e. financial year 2022-23) referred to as ASI 2022-23 in this press note. The field work for this survey was carried out during November 2023 to June 2024 for ASI 2022-23. A brief note about the survey ASI 2022-23 is given at the Endnote.

Annual Survey of Industries is conducted with the primary objective to provide a meaningful insight into the dynamics of change in the composition, growth and structure of various manufacturing industries in terms of output, value added, employment, capital formation and a host of other parameters. It provides valuable input to the National Accounts Statistics at national and state level. The results are prepared at state and major industry level. ASI 2022-23 results along with write-up are available in the website of the Ministry (https://www.mospi.gov.in).

Key highlights from the ASI 2022-23 results

- The results show that the Gross Value Added (GVA) grew by 7.3% in current prices in the year 2022-23 over 2021-22. Increase in input was 24.4% while output grew by 21.5% in the sector in 2022-23 over 2021-22.

- The year 2022-23 witnessed a growth in this sector for majority of the important economic parameters like invested capital, input, output, GVA, employment and wages and even surpassed the pre-pandemic level in absolute value terms.

- The main drivers of this growth in 2022-23 were industries like Manufacture of Basic metal, Coke & Refined Petroleum Products, Food Products, Chemical and Chemical products and Motor vehicles. These industries, taken together, contributed about 58% of the total output of the sector and showed output growth of 24.5% and GVA growth of 2.6% in comparison to 2021-22.

- The estimated number of persons engaged in this sector in 2022-23 has exceeded the pre-pandemic level (that is 2018-19) by more than 22.14 lakh. At the same time, average emoluments also registered an increase over previous year. Also, average emoluments per persons engaged in this sector had gone up by 6.3% in 2022-23 in comparison to 2021-22.

- Among the major states, in terms of GVA, Maharashtra ranked first in 2022-23 followed by Gujarat, Tamil Nadu, Karnataka and Uttar Pradesh. The top five states, taken together contributed more than 54% of the total manufacturing GVA of the country in 2022-23.

- The top five states employing highest number of persons in this sector were Tamil Nadu, Maharashtra, Gujarat, Uttar Pradesh and Karnataka in ASI 2022-23. Taken together, these states contributed about 55% of total manufacturing employment in the year 2022-23.

The value of some key parameters from ASI 2018-19 to ASI 2022-23 in current prices is given in the table 1.

Table 1: Value of a few key parameters from ASI 2018-19 to 2022-23 in current prices (Value figures are in Rupees Lakh)

| Year | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 |

| Fixed Capital | 34,66,06,975 | 36,41,35,165 | 36,94,38,562 | 37,26,35,444 | 41,21,79,458 |

| Invested Capital | 47,77,26,474 | 49,73,62,352 | 51,91,14,310 | 55,44,93,175 | 61,39,21,255 |

| Total Persons Engaged (No.) | 1,62,80,211 | 1,66,24,291 | 1,60,89,700 | 1,72,15,350 | 1,84,94,962 |

| Total Emoluments | 4,62,07,983 | 4,91,72,897 | 4,83,89,031 | 5,60,82,801 | 6,40,49,070 |

| Input | 77,43,77,980 | 74,97,55,617 | 71,92,06,541 | 98,79,17,996 | 1,22,89,54,623 |

| Output | 92,81,79,908 | 89,83,30,129 | 88,09,21,387 | 1,19,27,15,147 | 1,44,86,60,228 |

| GVA | 15,38,01,928 | 14,85,74,512 | 16,17,14,846 | 20,47,97,151 | 21,97,05,605 |

| Depreciation | 2,61,55,291 | 2,73,09,742 | 2,81,35,986 | 2,99,64,685 | 3,16,64,493 |

| NVA | 12,76,46,637 | 12,12,64,771 | 13,35,78,860 | 17,48,32,466 | 18,80,41,113 |

The value of some Structural Ratios & Technical Co-efficients from ASI 2018-19 to ASI 2022-23 in current prices is given in the table 2.

Table 2: Structural Ratios & Technical Co-efficients for last 5 years

| Year (ASI) | Unit | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 |

| Structural Ratios | ||||||

| Fixed Capital per Factory in operation | Rs Lakhs | 1,758 | 1,833 | 1,844 | 1,858 | 1,996 |

| Gross Output per Factory in operation | Rs Lakhs | 4,708 | 4,523 | 4,396 | 5,946 | 7,015 |

| Net Value Added per Factory in operation | Rs Lakhs | 647 | 611 | 667 | 872 | 911 |

| Workers per Factory in operation | Number | 65 | 66 | 63 | 68 | 71 |

| Total Persons Engaged per Factory in operation | Number | 83 | 84 | 80 | 86 | 90 |

| Fixed Capital per Persons Engaged | Rupees | 21,29,008 | 21,90,380 | 22,96,118 | 21,64,553 | 22,28,604 |

| Output per Worker | Rupees | 72,52,206 | 68,79,456 | 69,94,458 | 87,63,565 | 99,10,810 |

| Output per Persons Engaged | Rupees | 57,01,277 | 54,03,720 | 54,75,064 | 69,28,207 | 78,32,729 |

| Net Value Added per Worker | Rupees | 9,97,349 | 9,28,652 | 10,60,607 | 12,84,595 | 12,86,457 |

| Net Value Added per Persons Engaged | Rupees | 7,84,060 | 7,29,443 | 8,30,213 | 10,15,561 | 10,16,715 |

| Gross Value Added per Persons Engaged | Rupees | 9,44,717 | 8,93,719 | 10,05,083 | 11,89,619 | 11,87,921 |

| Emoluments per Persons Engaged | Rupees | 2,83,829 | 2,95,789 | 3,00,745 | 3,25,772 | 3,46,305 |

| Wages per Worker | Rupees | 1,68,581 | 1,75,297 | 1,76,755 | 1,94,387 | 2,05,175 |

| Technical Co-efficients | ||||||

| Fixed Capital to NVA | 2.72 | 3.00 | 2.77 | 2.13 | 2.19 | |

| Fixed Capital to Output | 0.37 | 0.41 | 0.42 | 0.31 | 0.28 | |

| NVA to Output | 0.14 | 0.13 | 0.15 | 0.15 | 0.13 | |

| GVA to Fixed Capital | 0.44 | 0.41 | 0.44 | 0.55 | 0.53 | |

| Output to Input | 1.20 | 1.20 | 1.22 | 1.21 | 1.18 | |

| Emoluments to NVA | 0.36 | 0.41 | 0.36 | 0.32 | 0.34 | |

| Contract Workers to Total Workers | 0.38 | 0.38 | 0.39 | 0.40 | 0.41 | |

Table 3: Top Industries

For a few important characteristics, top five industries (2-digit level of NIC) at all-India level having major percentage shares in the estimated value of overall aggregate are mentioned in the table below:

| Rank | Characteristics | ||||

| Total no. of Factories | Fixed Capital | Total Persons Engaged | Output | Gross Value Added (GVA) | |

| 1 | Food products (15.99%) | Basic Metals (17.59%) | Food Products

(11.44%) |

Basic Metals (14.86%) | Basic Metals (11.57%) |

| 2 | Other Non-Metallic Mineral Products

(11.57%) |

Coke & Refined Petroleum Products

(14.18%) |

Textiles

(9.31%) |

Coke & Refined Petroleum Products

(14.02%) |

Chemicals & Chemical Products

(9.83%) |

| 3 | Textiles

(7.15%) |

Other Industries (10.11%)

|

Basic Metals (7.63%) | Food Products

(12.36%) |

Coke & Refined Petroleum Products

(8.70%) |

| 4 | Fabricated metal products, (6.79%) | Chemicals & Chemical Products

(9.71%) |

Wearing Apparel

(7.14%) |

Chemicals & Chemical Products

(9.08%) |

Motor Vehicles, Trailers & Semi-Trailers

(8.07%) |

| 5 | Rubber and plastics products (6.07%) | Food products (7.28%) | Motor Vehicles, Trailers & Semi-Trailers

(6.84%) |

Motor Vehicles, Trailers & Semi-Trailers

(7.82%) |

Pharmaceuticals, Medicinal Chemical and Botanical Products

(7.34%) |

| Aggregate Total (all-industries)* | 2,53,334 | 41,21,79,458 | 1,84,94,962 | 1,44,86,60,228 | 21,97,05,605 |

(* Estimates of Fixed Capital, Output and GVA are in  Lakh)

Lakh)

Table 4: Top States

Top five states in terms of their percentage shares in the value of overall aggregates for each of the characteristics as under:

| Rank | Characteristics | ||||

| Total no. of factories | Fixed Capital | Total Persons Engaged | Output | Gross Value Added (GVA) | |

| 1 | Tamil Nadu

(15.66%) |

Gujarat

(19.64%) |

Tamil Nadu

(15.00%) |

Gujarat

(17.72%) |

Maharashtra

(16.33%) |

| 2 | Gujarat

(12.25%) |

Maharashtra (11.97%) | Maharashtra

(12.84%) |

Maharashtra (14.65%) | Gujarat

(14.78%) |

| 3 | Maharashtra (10.44%) | Odisha

(8.06%) |

Gujarat

(12.62%) |

Tamil Nadu

(9.97%) |

Tamil Nadu

(10.33%) |

| 4 | Uttar Pradesh

(7.54%) |

Tamil Nadu

(7.93%) |

Uttar Pradesh

(8.04%) |

Uttar Pradesh

(7.03%) |

Karnataka

(7.04%) |

| 5 | Andhra Pradesh

(6.51%) |

Karnataka

(6.10%) |

Karnataka

(6.58%) |

Karnataka

(6.17%) |

Uttar Pradesh

(6.09%) |

| Aggregate Total (all India level)* | 2,53,334 | 41,21,79,458 | 1,84,94,962 | 1,44,86,60,228 | 21,97,05,605 |

(* Estimates of Fixed Capital, Output and GVA are in  Lakh)

Lakh)

Visualizations from the ASI 2022-23 Results

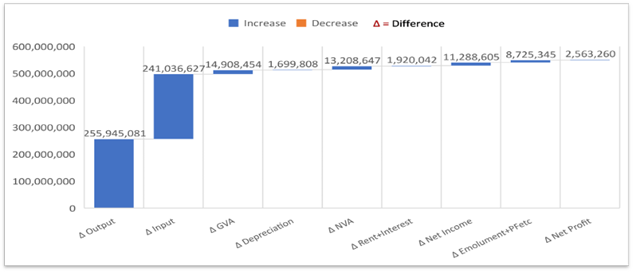

Chart-1: Waterfall chart showing change in absolute value (in ₹ Lakh) in a few important parameters from 2021-22 to 2022-23: All –India

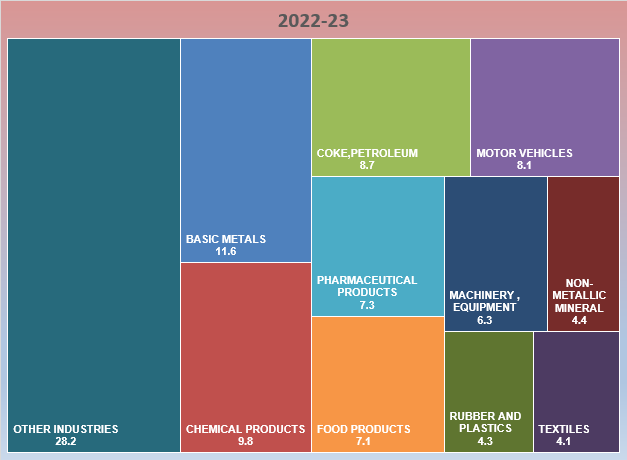

Chart-2: Tree map showing Top 10 industries account for 72% of Manufacturing GVA

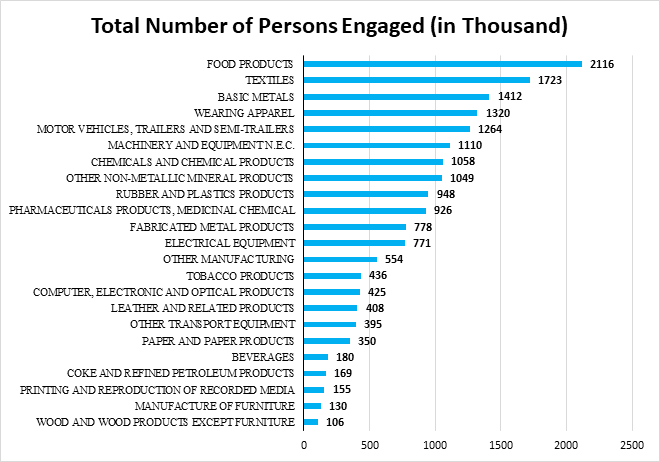

Chart-3: Bar chart showing the manufacturing employment by major sub-sectors in 2022-23

Endnote: A brief note about the Annual Survey of Industries (ASI) 2022-23

- Coverage of ASI:

The Annual Survey of Industries broadly covers the following

-

- Factories registered under Sections 2m(i) and 2m(ii) of the Factories Act,1948

- Bidi and cigar manufacturing establishments registered under the Bidi & Cigar Workers (Conditions of Employment) Act,1966

- Electricity undertakings engaged in generation, transmission and distribution of electricity, not registered with the Central Electricity Authority (CEA)

- Units with 100 or more employees registered in the Business Register of Establishments (BRE) prepared and maintained by the State Governments as and when such lists are shared by the respective State Governments.

- ASI frame and its updation

The ASI frame is based on the lists of registered factory / units maintained by the Chief Inspector of Factories (CIF) in each State and those maintained by registration authorities in respect of Bidi and Cigar establishments and electricity undertakings. The frame is being revised and updated periodically by the Regional Offices of the Field Operations Division of NSSO in consultation with the Chief Inspector of Factories in the State. At the time of revision, the names of the de-registered factories are removed from the ASI frame and those of the newly registered factories are added. For the units selected in the last survey year (in this case 2021-22), relevant fields like Status Code, Frame industry (NIC 4 digit), Employee (Total persons engaged), Address etc. of frame for a given year, say, ASI 2022-23 are auto-updated dynamically based on the information collected during the last survey year.

- Unit of Enumeration

The primary unit of enumeration in the survey is a factory in the case of manufacturing industries, a workshop in the case of repair services, an undertaking or a licensee in the case of electricity, gas & water supply undertakings and an establishment in the case of bidi & cigar industries. The owner of two or more establishments located in the same State and pertaining to the same industry group and belonging to census scheme is, however, permitted to furnish a single consolidated return. Such consolidated returns are common feature in the case of bidi and cigar establishments, electricity and certain public sector undertakings.

- Sampling Strategy and Sample Size:

According to the sampling design followed in ASI 2022-23, all the units in the updated frame are divided into two parts – Central Sample and State Sample. The Central Sample consists of two schemes: Census and Sample. Under Census scheme, all the units are surveyed. Census Scheme consists of the following:

(i) All industrial units belonging to the nine less industrially developed States/ UTs viz. Arunachal Pradesh, Manipur, Meghalaya, Nagaland, Sikkim, Tripura, Mizoram, Andaman & Nicobar Islands and Ladakh.

(ii) All industrial units with Frame NIC = 0893 (Salt Extraction).

(iii) For the States/ UTs other than those mentioned in (i) and (ii),

- units having 75 or more employees from six States/UTs, namely, Jammu & Kashmir, Himachal Pradesh, Rajasthan, Bihar, Chhattisgarh and Kerala;

- units having 50 or more employees from three States/UTs, namely, Chandigarh, Delhi and Puducherry;

- units having 100 or more employees for rest of the States/UTs, not mentioned in (a) and (b) above and;

(iv) All factories covered under ‘Joint Return’ (JR), where JR is allowed when the two or more units located in the same State/UT, same sector and belong to the same industry (3-digit level of NIC-2008) under the same management.

(v) After excluding the Census Scheme units in the above manner, all units belonging to the strata (State x District x Sector x 3-digit NIC-2008) having less than or equal to 4 units are also considered under Census Scheme. It may be noted that strata are separately formed under three sectors considered as Bidi, Manufacturing and Electricity.

(vi) All the remaining units in the frame are considered under Sample Scheme. For all the states, each stratum is formed on the basis of State x District x Sector x 3-digit NIC-2008. The units are arranged in descending order of their total number of employees. Samples are drawn using Circular Systematic Sampling technique for this scheme. An even number of units with a minimum of 4 units are selected and distributed in four sub-samples. It may be noted that in certain cases each of 4 sub-samples from a particular stratum may not have equal number of units.

(vii) Out of these 4 sub-samples, two pre-assigned sub-samples are given to NSSO (FOD) and the other two-subsamples are given to State/UT for data collection.

(viii) The entire census units plus all the units belonging to the two sub-samples given to NSSO (FOD) are treated as the Central Sample.

(ix) The entire census units plus all the units belonging to the two sub-samples given to State/UT are treated as the State Sample.

(x) The entire census units plus all the units belonging to the two sub-samples given to NSSO (FOD) plus all the units belonging to the two sub-samples given to State/UT are required for pooling of Central Sample and State Sample.

It may be noted that samples were drawn considering an average sampling fraction for the sample sector as 8%. The size of the live frame for ASI 2022-23 containing units with

status ‘open’, ‘Existing with fixed assets and maintaining staff but not having production’ or ‘Existing with fixed assets but not maintaining staff and not having production’, was 2,55,244. Total sample size for Central sample in ASI 2022-23 was 82,734 (62,778 Census and 19,956 Sample). For further details please refer to the website of the Ministry https://www.mospi.gov.in.

- Industrial Classification:

From 1959 onwards, an industrial classification named ‘Classification of Indian Industries’ was adopted in ASI. With effect from ASI 1973-74, the National Industrial Classification (NIC) 1970 developed subsequently on the basis of UNISIC 1968 (Rev.2) was used. The NIC 1987 that followed UNISIC 1968 was adapted from ASI 1989- 90 to ASI 1997-98. The NIC 1998, developed on the basis of UNISIC, 1990 (Rev. 3) was used from ASI 1998-99 to ASI 2003-04. NIC 2004, developed on the basis of UNISIC 2002 (Rev. 3.1) had been used from ASI 2004-05 to 2007-08. NIC 2008 developed on the basis of UNISIC Rev 4 has been adopted from ASI 2008-09 onwards and is still being used.

- National Product Classification for Manufacturing Sector (NPCMS):

Central Product Classification (CPC) serves as the reference classification for all product classifications within the international system of economic classifications put in place by the United Nations. It is a complete product classification covering all goods and services that follows the definition of products within the SNA framework. The National Product Classification for Manufacturing Sector (NPCMS), 2011 was developed based on Sections 0 to 4 of CPC, Ver. 2.0 that relate to products of manufacturing sector. The NPCMS, 2011 is a 7-digit classification and the structure is: 5-digit CPC Code + 2-digit Indian requirement. From ASI 2010-2011 onwards, the 7-digit codes and their description as per NPCMS, 2011 are being used for collecting and recording of all input and output items in ASI schedule. From ASI 2015-16 onwards, revised version of NPCMS, 2011 is used to classify the input and output items collected in ASI schedule.

- Schedule of enquiry

The schedule for ASI 2022-23 has two parts – Part-I and II. Part-I , processed at the IS Wing, Kolkata, aims to collect data on assets and liabilities, employment and labour cost, receipts, expenses, input items – indigenous and imported, products and by-products, distributive expenses etc. Part-II, processed by the Labour Bureau, aims to collect data on different aspects of labour statistics, namely, working days, man-days worked, absenteeism, labour turnover, man-hours worked, earning and social security benefits.

- Concepts and Definitions of important items collected through the schedule of enquiry

The concepts and definitions of items collected through ASI schedule are given below:

Reference Year for ASI 2022-23 is the accounting year of the factory ending on 31st March 2023.

Factory is one that is registered under sections 2m (i) and 2m (ii) of the Factories Act, 1948. The sections 2m (i) and 2m (ii) refer to any premises including the precincts thereof (a) whereon ten or more workers are working, or were working on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on with the aid of power, or is ordinarily so carried on; or (b) whereon twenty or more workers are working or were working on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on without the aid of power, or is ordinarily so carried on.

Fixed Capital represents the depreciated value of fixed assets owned by the factory as on the closing day of the accounting year. Fixed assets are those that have a normal productive life of more than one year. Fixed capital includes land including lease- hold land, buildings, plant & machinery, furniture and fixtures, transport equipment, water system and roadways and other fixed assets such as hospitals, schools, etc. used for the benefit of the factory personnel.

Physical Working Capital is the total inventories comprising of raw materials and components, fuels and lubricants, spares, stores and others, semi-finished goods and finished goods as on the closing day of the accounting year. However, it does not include the stock of the materials, fuels, stores, etc. supplied by others to the factory for processing and finished goods processed by the factory from raw materials supplied by others.

Invested Capital is the total of fixed capital and physical working capital as defined above.

Workers are defined to include all persons employed directly or through any agency whether for wages or not and engaged in any manufacturing process or in cleaning any part of the machinery or premises used for manufacturing process or in any other kind of work incidental to or connected with the manufacturing process or the subject of the manufacturing process. Labour engaged in the repair & maintenance, or production of fixed assets for factory’s own use, or employed for generating electricity, or producing coal, gas etc. are included.

Employees include all workers defined above and persons receiving wages and holding clerical or supervisory or managerial positions engaged in administrative office, store keeping section and welfare section, sales department as also those engaged in purchase of raw materials etc. or purchase of fixed assets for the factory as well as watch and ward staff.

Total Persons Engaged include the employees as defined above and all working proprietors and their family members who are actively engaged in the work of the factory even without any pay, and the unpaid members of the co-operative societies who worked in or for the factory in any direct and productive capacity. The number of workers or employees is an average number obtained by dividing mandays worked by the number of days the factory had worked during the reference year.

Wages and Salaries are defined to include all remuneration in monetary terms and also payable more or less regularly in each pay period to workers as compensation for work done during the accounting year. It includes

(a) direct wages and salary (i.e., basic wages/salaries, payment of overtime, dearness, compensatory allowance, house rent and other allowances), (b) remuneration for the period not worked (i.e., basic wages, salaries and allowances payable for leave period, paid holiday, lay-off payments and compensation for unemployment, if not paid from sources other than employers), (c) bonuses and ex-gratia payment paid both at regular and less frequent intervals (i.e., incentive bonuses, good attendance bonuses, productive bonuses, profit sharing bonuses, festival or year-end bonuses, etc.). It excludes lay off payments which are made from trust or other special funds set up exclusively for this purpose i.e., payments not made by the employer. It also excludes imputed value of benefits in kind, employer’s contribution to old age benefits and other social security charges, direct expenditure on maternity benefits and crèches and other group benefits. Travelling and other expenditure incurred for business purposes and reimbursed by the employer are excluded. The wages are expressed in terms of gross value i.e., before deduction for fines, damages, taxes, provident fund, employee’s state insurance contribution, etc.

Contribution to Provident Fund and Other Funds includes old age benefits like provident fund, pension, gratuity, etc. and employers contribution towards other social security charges such as employees state insurance, compensation for work injuries and occupational diseases, provident fund-linked insurance, retrenchment and lay- off benefits.

Workmen and Staff Welfare Expenses include group benefits like direct expenditure on maternity, crèches, canteen facilities, educational, cultural and recreational facilities; and grants to trade unions, co-operative stores, etc. meant for employees.

Total Emoluments is defined as the sum of wages and salaries including bonus.

Input comprises total value of fuels and materials consumed as well as expenditures such as cost of contract and commission work done by others on materials supplied by the factory, cost of materials consumed for repair and maintenance of factory’s fixed assets including cost of repairs and maintenance work done by others to the factory’s fixed assets, rent paid for buildings and plant & machinery and other fixed assets, inward freight and transport charges, rates and taxes (excluding income tax), postage, telephone and telex expenses, banking charges, cost of printing and stationery, R&D expenses, expenses on raw materials and other components for own construction and purchase value of goods sold in the same condition as purchased .

Output comprises total ex-factory value of products and by-products manufactured as well as other receipts such as receipts from manufacturing and non-industrial services rendered to others, work done for others on material supplied by them, value of electricity produced and sold, rent received for building, plant & machinery and other fixed assets, sale value of goods sold in the same condition as purchased, addition in stock of semi- finished goods, value of own construction and an amount equal to expenses on research & development (R&D).

Depreciation is consumption of fixed capital due to wear & tear and obsolescence during the accounting year and is taken as provided by the factory owner or is estimated on the basis of cost of installation and working life of the fixed assets.

Gross Value Added (GVA) is defined as additional value created by the process of production. This is calculated by deducting the value of total input from total output.

Net Value Added (NVA) is arrived by deducting total input and depreciation from total output.

- Data Collection Mechanism:

Data for ASI are collected from the selected factories under the Collection of Statistics Act 2008 as amended in 2017 and Rules framed there under in 2011. The entire survey is conducted through a dedicated web-portal without any paper schedule. For data collection in ASI, an establishment (and not enterprise) approach is followed wherein data are collected from the selected establishments.

- Survey Disclaimer:

Various quality checks are carried out on the data collected through this survey which is primarily record- based. Relative Standard Errors (RSE) (which is a widely accepted statistical measure of reliability of an estimate) for important parameters estimated from the survey at an overall level are small and well within the acceptable range. However, since the data presented in this result are estimated from sample survey, necessary caution may be taken while using this data (for details please refer to the website of the Ministry https://www.mospi.gov.in).

Comments are closed.