Are you an earning member of the family? If yes, have you thought about starting an investment? Starting an investment can never go wrong, whether you are a provider or a beginner. Everybody wants to work, but nobody knows what to do during retirement. Taking a small, informed step towards investment can significantly impact your future quality of life. You can evaluate that with the help of tools like lump sum calculators, which help you give an idea about the maturity value of your investment amount. Let us know this investment type and how Lump Sum calculators can be helpful in planning your retirement.

What is a Lump Sum Investment?

A lump sum investment is a one-time investment in mutual funds to generate compounding returns over a given time frame. This investment type can yield the best results for short-term goals. Tools like the Lump Sum calculator help you know the maturity value of your investment.

What Is a Lump Sum Calculator?

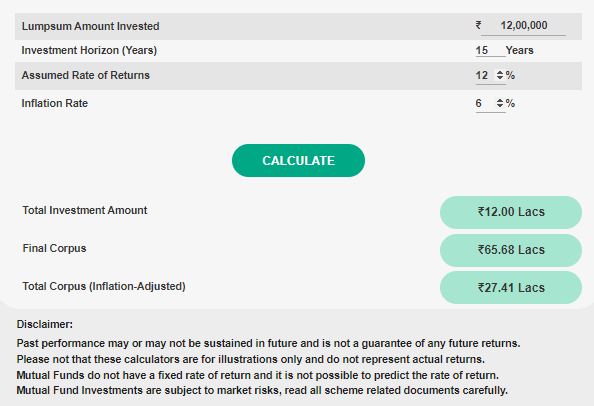

A lump sum calculator is a tool that can calculate the maturity value of your investment. This Lumpsum Calculator tells the future value of your investment made in the present. You invest 1 lakh rupees for 60 years at a 15% interest rate. Then, according to the lumpsum calculator, the future value of your investments will be 43.8 cr after 60 years.

How does this Lump Sum Calculator work?

A lump sum SIP calculator is convenient for everyone and is handy. Lumpsum Calculator requires you to enter the necessary inputs, such as the amount you are willing to invest, the time period, and the expected rate of return per annum that you think the investment will give. After entering the required information, the calculator will provide you with the future value of your assets.

Why Invest In Lumpsum Mutual Funds?

1. Potential Returns

Lump sum investments allow investors to invest a larger amount of money in the market in one go, which allows the money to grow more over time, potentially leading to higher returns in the long run, especially when the markets are experiencing an upward trend.

2. Benefit of Compounding

Lump Sum investments take advantage of the power of compounding. Since a large sum of money is invested for a long time, accumulating compound interest can significantly intensify returns over time.

3. Flexibility

Lumpsum investing offers flexibility to pay the amount in one go rather than pay a particular amount in regular intervals, making it a preferred choice for people with a significant amount of cash, such as estate, bonus, or savings.

Why Should You Use A Lump Sum Calculator For Planning Your Retirement?

A Lump Sum calculator can help you assess and estimate future value if you are planning your retirement. A lump sum calculator offers various advantages for anyone looking to make informed financial decisions for retirement.

- Provides Clear Estimates

The lump sum calculator provides a precise estimate of the future value of your investment and how your lump sum investment can grow, helping you make an informed decision that aligns with your financial goals.

2. Helps find the Best Options

You can browse and compare different investment options using a lump sum calculator, select the one that is best for retirement, and choose the one that best aligns with your goals.

3. Helps to Set a Goal

Whether you are saving for a wedding, retirement, renovation, or a child’s education, the lumpsum calculator assists in setting precise financial goals.

4. Motivates to Save

The Lump Sum calculator helps create a strategy that motivates saving for your retirement phase by showing the value of long-term investments and encouraging regular, consistent contributions.

5. Helps assess Risk

If you plan to invest in different units, the lumpsum calculator can help you compare and evaluate its potential risks.

Conclusion

If you are planning your retirement, the most essential thing investing in a lump sum investment is to evaluate your financial goal and then evaluate how and what the investment will yield. Lump sum calculators play an important role in estimating some essential factors. It helps assess risk, identify goals, and help you plan your finances accordingly. So, if you are investing in Lumpsum, Lump Sum calculators can give you insights in seconds.

Comments are closed.