New Delhi: The Government proposes to permit taxpayers to file an updated return on payment of additional tax within two years from the end of the relevant assessment year announced the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2022-23 in the Parliament today. She said this would give taxpayers an opportunity to correct any omissions or mistakes in correctly estimating their income for tax payment. She pointed out that currently, if the department finds out that some income has been missed out by the assessee, it goes through a lengthy process of adjudication, the new proposal would repose trust in the taxpayer. She said “It is an affirmative step in the direction of voluntary tax compliance”.

Tax Relief to Persons with Disability

The law currently provides for deduction to the parent or guardian when they take an insurance scheme for the differently abled person only if the lump sum payment or annuity is available to the differently abled person on the death of the subscriber. Pointing out that there could be situations where differently abled dependants may need payment of annuity or lump sum amount even during the lifetime of their parents/guardians, Smt. Sitharaman announced that the Government proposes to allow the payment of annuity and lump sum amount to the differently abled dependent during the lifetime of parents/guardians, on subscribers attaining the age of sixty years.

Parity between Employees of State and Central Government

The minister said that to enhance the social security benefits of the State government employees and bring them at par with the central government employees, the Government proposes to increase the tax deduction limit to 14 per cent from 10 per cent on employer’s contribution to the NPS account of State Government employees.

Scheme for Taxation of Virtual Digital Assets

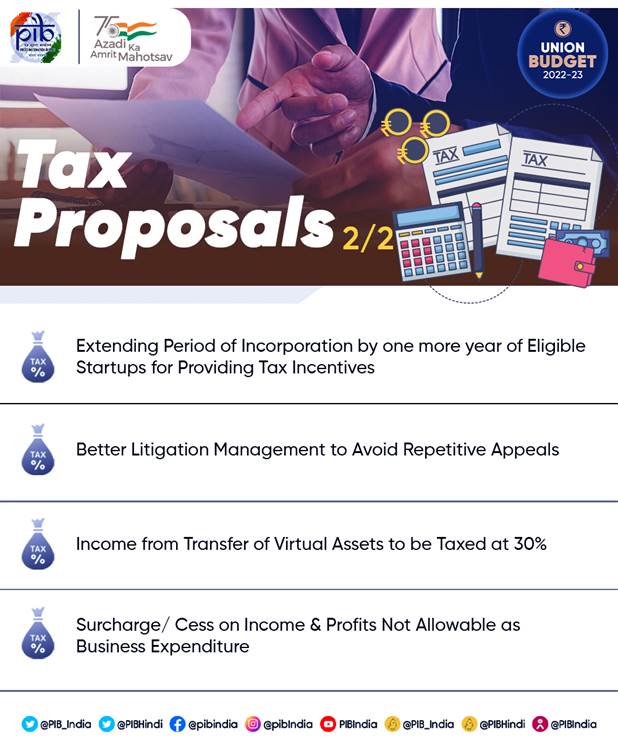

Stating that the magnitude and frequency of transactions in virtual digital assets have increased phenomenally, Smt. Sitharaman announced that “any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent”. She said that the scheme would not allow any deduction in respect of any expenditure or allowance while computing such income except cost of acquisition. Further she said, loss from transfer of virtual digital asset cannot be set off against any other income. The minister also added that in order to capture the transaction details, the Government would also make a provision to provide for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold. Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient, she said.

Litigation Management

Smt. Sitharaman stated that “a lot of time and resources are consumed in filing of appeals which involve identical issues”. In order to take forward the Government’s policy of sound litigation management and reduce repeated litigation between taxpayers and the department, the Government would make a provision that if a question of law in the case of an assessee is identical to a question of law which is pending in appeal before the jurisdictional High Court or the Supreme Court in any case, the filing of further appeal in the case of this assessee by the department shall be deferred till such question of law is decided by the jurisdictional High Court or the Supreme Court.

The minister also thanked the taxpayers of the country who have contributed immensely and strengthened the hands of the Government in helping their fellow citizens in the hour of need.

Comments are closed.