The Burden of Surging Healthcare Costs in India

Surging healthcare expenses and increase in the number of disease and disorders is taking a huge toll on the poor.

To the global trotter, India is becoming a landing place of array for medical tourism, with a chain of super-speciality hospitals in India offering medical care at lower rates than that in the developed countries. But for many Indians, healthcare is becoming unaffordable, owing to surging costs of treatment in the recent past.

Many people have health insurance as a backup. People, these days, are well aware of healthcare activities and do take care of their health. When it comes to getting the best health coverage, they make sure to compare health insurance policies offered by various insurance companies across the market. This is because of the skyrocketing cost of medical treatment at hospitals nationwide. Needless to say, nobody wants to shell out lakhs from their pocket when they can take care of themselves instead.

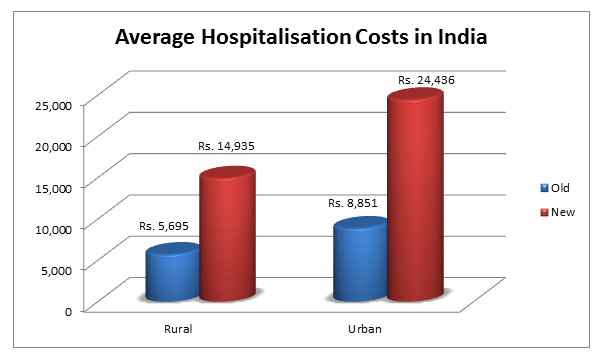

As the cost of treatment is rising at a fast pace, exceeding the average inflation in both urban and rural India over the past ten years, the results of a survey on health conducted by the National Sample Survey Office (NSSO) is shown below.

As growing patients flock towards private hospitals and clinics for treatment, they have faced heavy medical bills. The costs of treatment differ considerably across states of India.

Let’s see the highest hospitalisation costs in rural India:

And, the states with lowest hospitalisation costs in rural India:

As the data shows in the images, in rural part of the country, states that have higher proportion of individuals looking for medical care in the private hospitals face high costs. In states like Haryana, Punjab, Uttar Pradesh and Maharashtra, a large chunk of people are turning to the private clinics or hospitals for treatment.

On the other hand, in states like Assam and Odessa, the cost of rural hospitalisation is low as those of government hospitals. One important caution that you must keep in mind is that lower levels of health awareness and poverty lead to lower the reporting of ailment, and lower rates of hospitalisation in some of the states, as first portion of this series pointed out.

In the urban cities of India also, the hospitalisation costs pattern is largely alike, as depicted in the image below:

The states that have the highest hospitalisation costs in urban India:

The states that have lowest hospitalisation expenses in urban India:

A research on the medical care’s quality in private and public hospitals in India by Alaka Holla and Jishnu Das of the World Bank, and Karthik Muralidharan of the University of California, Sa Diego, and Aakash Mohpal of the University of Michigan, proves that though private medical doctors or practitioners might often over-charge their patient (and commend unnecessary medical tests), on balance they offer quality care as compared to the public hospitals.

This assists explain why the ratio of individuals who visit private hospitals in urban cities has escalated by almost 6% points to 68% over the last ten years, and why the ratio of the individuals using government hospitals in rural India has remained almost unchanged regardless of a huge expansion of the rural health infrastructure over the past ten years.

The forlorn state of public health centre and hospitals is compelling a rising number of patients to rely on private medical clinics. This, consecutively, has escalated costs and led to increasing fiscal stress in absence of any insurance coverage for diseases. 86 percent of the rural Indian patients and 82 percent of the urban Indian patients don’t have an access to any form of the state-funded insurance or employer-provided insurance, as per NSSO’s latest survey.

Looking at this data it is clear that the lack of effectual state intervention in the healthcare sector has made our country an outlier amongst the emerging market economies while talking about health outcomes. Also, it is suggested to compare health insurance in India to get the best plan as per your needs and requirements.

While the average costs of hospitalisation for the top income class roughly equivalent to the yearly consumption expenses of this class, the average cost of hospitalisation are approximately double the yearly expenses of the bottom quintile.

Here, buying a health insurance policy can be of great help.

The cost of the treatment is rising at an alarming rate. In India, the medical inflation rate is increasing at 20% p.a., which is more than double the total inflation. A health insurance plan put a stop to medical contingencies from turning into a fiscal contingency. It ensures that your health care requirements are managed without depletion of your savings and bargaining on your future goals. The medical insurance contract needs the insurance company to pay a few or all of your health care expenses in exchange for periodic reimbursement. Extra benefits of health insurance plans consist of cashless services, health check-ups at regular intervals, pre-hospitalisation and post-hospitalisation cost reimbursements etc.

Over to you!

It is important that you compare health insurance policy online before buying any plan for you and your loved ones so as to select the best policy for their health requirements. There are a lot of insurance providers that offer health insurance plans and each of these providers has a different set of advantages and features that it gets confusing to choose the best for you.

Image Source: livemint.com

Comments are closed.